long term care insurance washington state tax opt out

The program will initially pay out 36500 in long. Any employee who attests that they have comparable long-term care insurance purchased before November 1.

Ltc Insurance What Is The Long Term Care Tax In Washington State King5 Com

Time is Running Out.

. In comparison the cost of care for a 3-year long-term care claim event projected out in 30 years is around 1000000. In that case the tax will be permanent. Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care.

If you have private long-term-care insurance LTCI and want to opt out of a new long-term-care payroll tax starting in January you can apply for an exemption with the state of. That opt-out set off an aggressive marketing campaign by long-term care insurance brokers looking to sell policies to people trying to avoid the new tax. You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021.

The window to apply for an exemption. In WA the amount of coverage was 36500 with nominal. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline.

This is a permanent opt-out once out you cannot opt back in. This means there will be 36000 available for long-term care expenses for everyone paying into the fund. Washington workers have until Nov.

You needed to apply earlier to have coverage in place by. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax. There is no indication that the opt.

Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply. This means that if you purchased a private long-term care policy that you should not cancel it. Opting Out of The Washington State Long-Term Care Tax After an employees application for exemption is processed and approved he or she will receive an approval letter.

So if you make 75000 a year youll pay 435 a year. While many Washingtonians purchased small Long-Term Care Insurance plans to avoid the tax most LTC Insurance plans will pay substantially more in benefits than the 100 a. They reluctantly allowed a single opt-out choice that expires Nov.

Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to an. In 2019 Democrats in Olympia passed a hefty new payroll tax that will hit paychecks starting in January. Individuals who have private long-term care insurance may opt-out.

The tax pays for a 36000 lifetime long-term care benefit. First to opt out you need private qualifying long term care coverage in force before November 1 2021. It is too late.

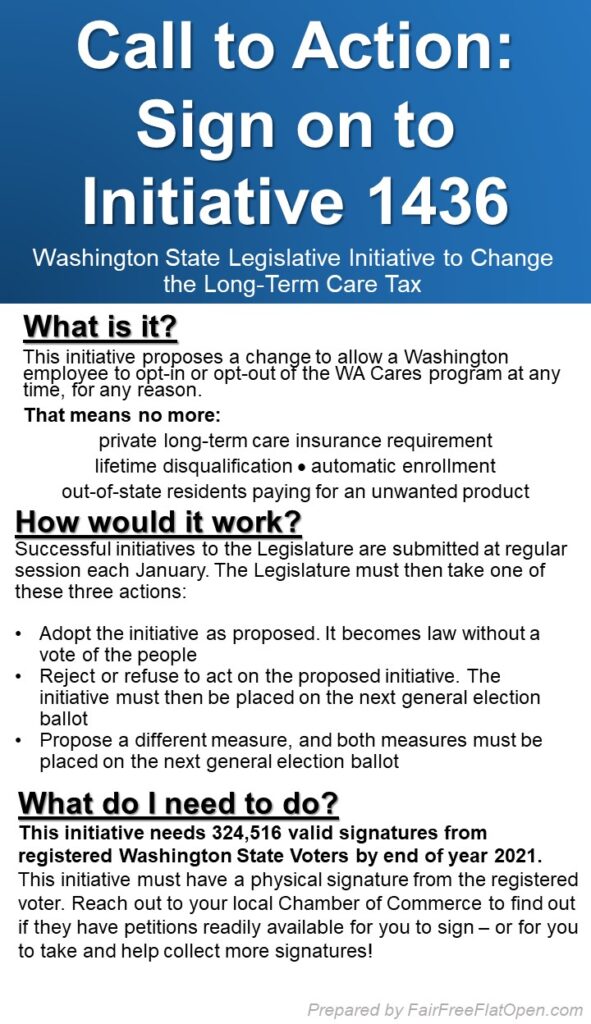

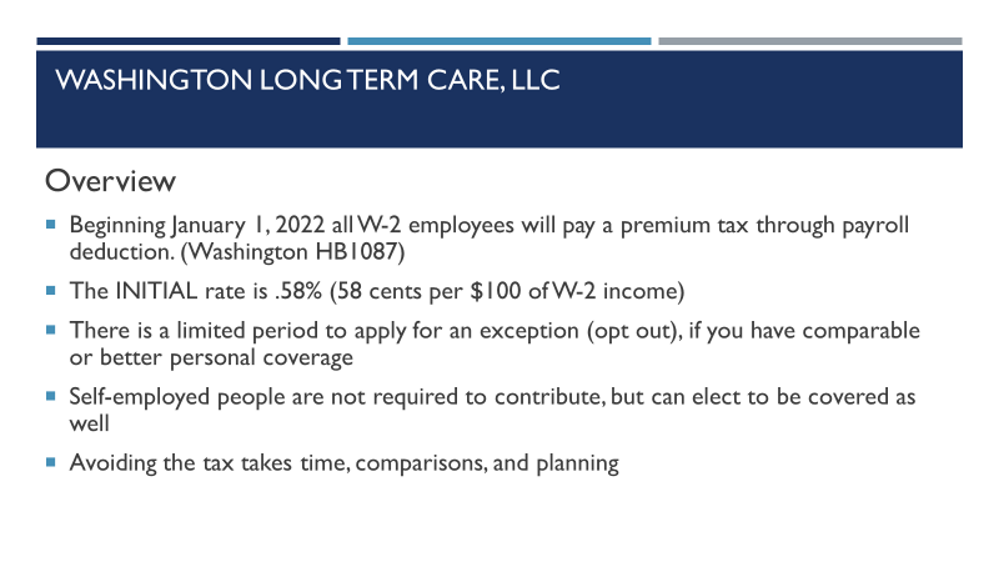

Back in 2019 the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee. 1 to opt out of the states long-term care program which will help pay for nursing care and other support services for people who can no. Update April 16 2021.

Opting back in is not an option provided in current. 1 every employee will pay 58 cents for every 100 they earn. The tax has not been repealed it has been delayed.

The only exception is to opt out by purchasing.

Opening Day Woe And Initiative Weal Washington State Ltc Opt Out A Bust But Initiative Gathers Steam Fair Free Flat Open

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Thousands Of Washingtonians Look To Opt Out Of Long Term Care Insurance Tax Business Daily News Mcknight S Senior Living

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

Time To Opt Out Of New Washington State Ltc Insurance Tax Dwindling King5 Com

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

Opinion New Payroll Tax To Hit Workers This Fall For Mandated Long Term Care Program But State Commission Has Few Answers On How It Will Work Clarkcountytoday Com

Washington Officials If You Re Hoping To Avoid The State S New Long Term Care Tax You Should Apply For An Exemption Soon

Wa Legislature Oks Pause To Long Term Care Program And Tax

Washington Ltc Trust Act Opt Out Long Term Care Insurance For The Ones You Love

Payroll Washington Long Term Care Llc

Know Your Options For Private Long Term Care Insurance King5 Com

Washington S Long Term Care Program Wa Cares Survives Another Challenge The Seattle Times

A Big Deadline For Washington S Long Term Care Program Is Almost Here Seattle Met

Gov Inslee Delays Start Of Washington S New Long Term Care Tax King5 Com

Long Term Care State Payroll Tax Update Buddyins

Who Should Opt Out Of Washington S New Long Term Care Insurance Program King5 Com